GBP/JPY pops up hanging man @ 38.2% Fibos in consolidation phase : FxWirePro | December 6, 2017

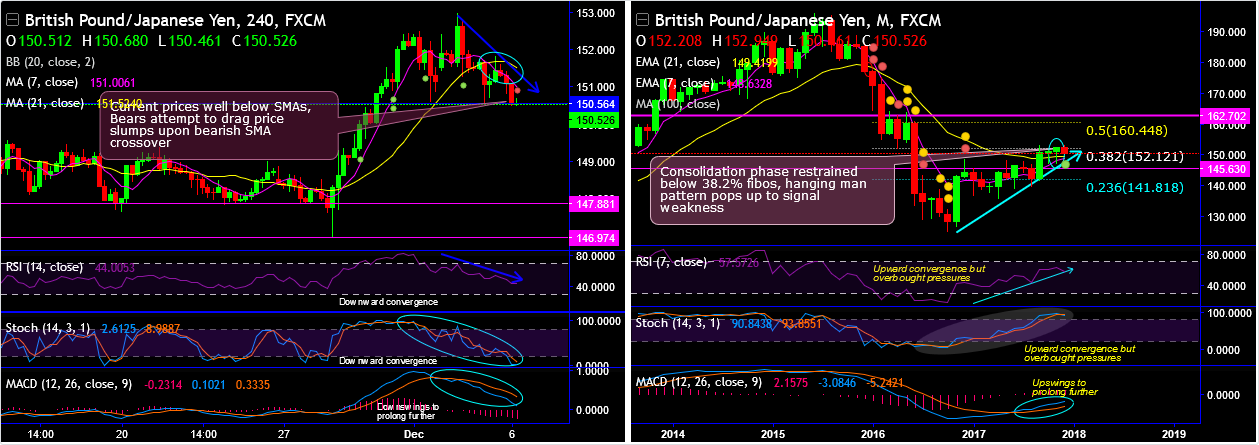

GBPJPY -0.65% shooting star has been popping up quite often at the peaks of rallies (at 151.094, 149.059 and 150.663 levels on weekly plotting).

The stiff resistance is observed at 152.935 levels.

These bearish patterns prove “history repeats again” in the intermediate trend, engulfing candle like pattern likely to drag price slumps. Well, the current prices have gone well below SMAs. For now, the bears are attempting to drag price slumps and breach below strong support at 150.564 levels upon bearish SMA crossover.

Although GBPJPY -0.65% halted price drops in this current trading session at 150.588 levels, after streaks of bearish swings we’ve seen stern bearish candle with big real body in the previous session at 150.512 levels, the bulls attempting to counter without the support from momentum indicators despite the prevailing bearish sentiments lingering around the corner (refer 4H chart).

Well on a broader perspective: The major trend has been in consolidation phase but restrained at 38.2% Fibonacci retracement levels from the lows of 124.786 levels, consequently, the hanging man pattern pops up to signal weakness at this juncture.

From last two-three months’ downswings have taken the pair to slide near EMAs (refer monthly chart).

In consolidation phase, the breach below EMA levels is likely to drag slumps towards 145 levels.

Buying momentum is shrinking away in this timeframe.

While MACD on the contrary, signals indecisiveness on monthly terms remaining in the bearish territory but the same has signaled the extension of the bearish trend on intraday terms.

The stochastic oscillator has entered into oversold trajectory but absolutely no traces of %k crossover. Instead, selling momentum has been intensified.

While RSI has also been converging to the price drops that lead the robust strength in the downtrend.

Monthly RSI (14) is trending below 58 levels that signal losing strength in the previous buying interests.

Well, overall we anchor the prevailing bearish stance is backed by both leading as well as lagging oscillators, one can think of shorts in this pair only for the short-to-medium terms basis.

Trade tips:

For the daily trading, one touch binary put options are the best suitable trading strategy, so snap the rallies to deploy higher strikes in the binary puts in order gain the leveraging effects in the yields.

Currency Strength Index: FxWirePro's hourly GBP spot index is flashing -143 (which is highly bearish ), while hourly JPY spot index was at 20 (which is neutral) while articulating (at 07:08 GMT ).

The indices values are also in tandem with our analysis and the strategy advocated.

Submit Your Comments:

FOREX VPS FOR TRADERS

FF FOREX VPS

Windows 2012R2/2016 | Server Location Amsterdam, France, Canada | Low Latency From Brokers| Super Fast Trading Experience | All types of EA supported | 3 Days Money Back Guarantee

| Plan Name | Buy Link | CPU | RAM | Disk | BandWidth | Price (Montly) | Price (Quarterly) | Price (Semi-Annually ) | Price (Annually) | Installation | BackUp | Setup Fee |

| ECO-01 | buy now | 1 Core | 756MB | 18GB | Unmetered | $4.99/M | $4.49/M | $3.99/M | $2.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-02 | buy now | 1 Core | 1GB | 22GB | Unmetered | $5.99/M | $5.49/M | $4.99/M | $3.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-03 | buy now | 2 Core | 2GB | 30GB | Unmetered | $9.99/M | $9.49/M | $8.99/M | $7.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-04 | buy now | 2 Core | 3GB | 32GB | Unmetered | $13.99/M | $13.49/M | $12.99/M | $11.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-05 | buy now | 3 Core | 4GB | 40GB | Unmetered | $17.99/M | $17.49/M | $16.99/M | $15.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-06 | buy now | 3 Core | 5GB | 45GB | Unmetered | $21.99/M | $21.49/M | $20.99/M | $19.99/M | MT4 Pre-Installed | Yes | Free |

***We accept Paypal, Perfect Money, Bitcoin !